GST registration is mandatory for certain businesses. According to GST rules, businesses with turnover above ₹40 lakhs must register as a normal taxable entity. This process of registering a business under Goods & Services Tax (GST) is called GST registration.

If the organization carries on business without registering under GST, it will be an offense under GST, and heavy penalties apply. Read to know more about the GST threshold limit, process, documents required, and fees of GST registration.

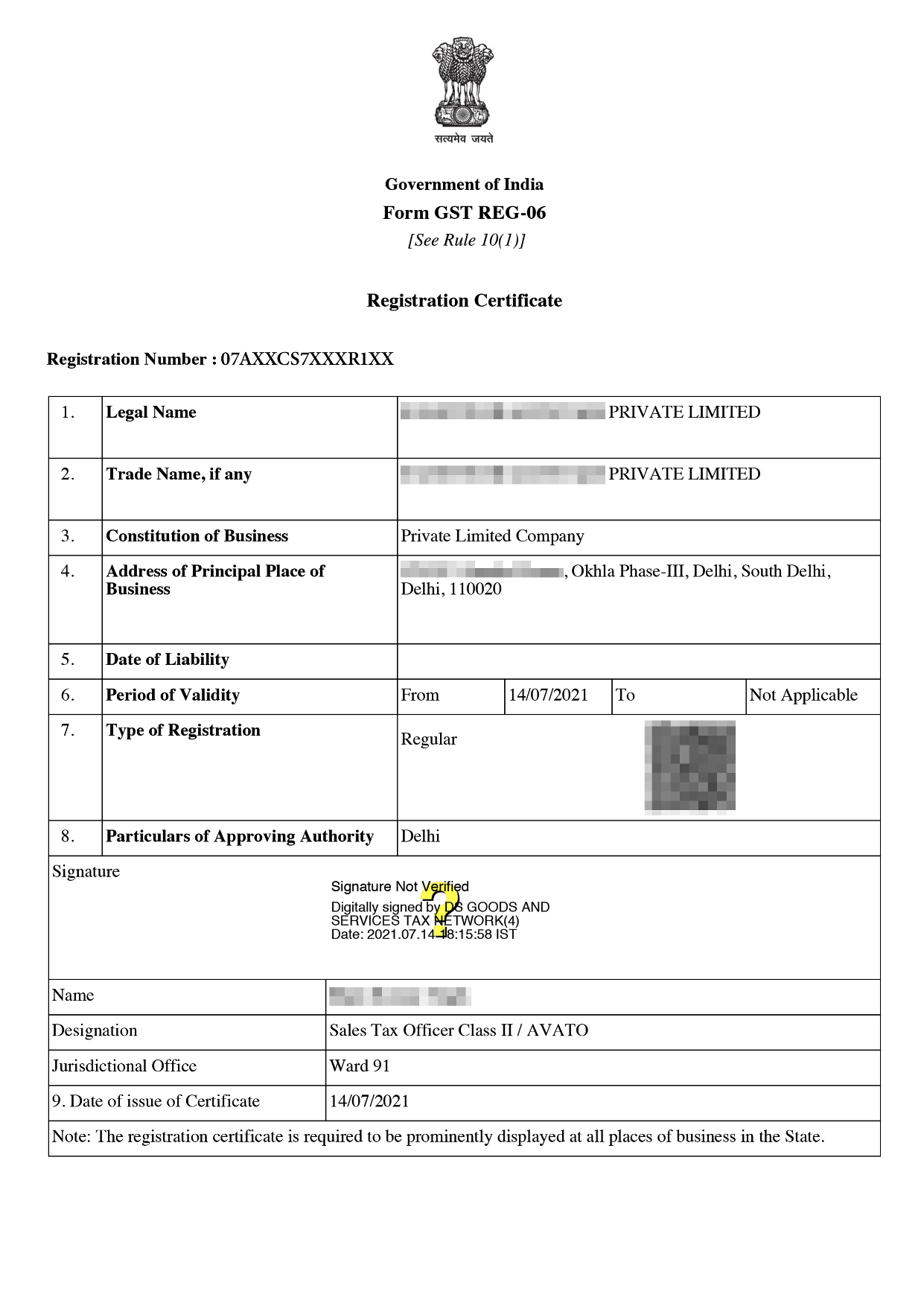

GST Registration [Sample]

Businesses above the threshold limit of ₹40 Lakhs are required to register under GST mandatorily. The turnover is ₹10 Lakhs for businesses that are present in hill states and North-Eastern states. The GST registration process is completed within 6 working days.

After completing the GST registration process, the Central Government provides a Goods and Service Tax Identification Number (GSTIN). The unique 15-digit GSTIN is used to determine whether a business is liable to pay GST.

The procedure of GST registration is as follows:

The total cost of registering a business under GST with Professional Utilities is ₹1499 Only!

Note: The aformentioned Fees is exclusive of GST.

If you do not pay tax or pay a lesser amount than what is due, the levied penalty is 10% of the due amount (in case of genuine errors). However, the minimum penalty is ₹10,000.

If you have not registered for GST and are deliberately trying to evade tax, the penalty levied is 100% of the due tax amount.

At Liquetax, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.